Grahamian Value Week in Review ― September 25, 2020

“For a value investor, price has to be the starting point. It has been demonstrated time and time again that no asset is so good that it can’t become a bad investment if bought at too high a price. And there are few assets so bad that they can’t be a good investment when bought cheap enough.”

― Howard Marks, The Most Important Thing: Uncommon Sense for the Thoughtful Investor (pg 24)

PART ONE.

WEEK IN REVIEW

PART TWO.

COMMUNITY INSIGHTS

In the past week —

We added an in-house data room containing detailed analytics, curated insights, and select primary source data for Dawson Geophysical Co. — available upon request per last week’s GV Week in Review.

We have continued adding detailed historical data and select insights to Grahamian Value listed company profiles.

I. WEEK IN REVIEW

Developments at three Grahamian Value listed companies have piqued our interest.

As those who requested access to our data room know, the COO of Dawson Geophysical recently sold 16,603 shares of stock — leaving him with beneficial ownership of 105,002 shares.

The only new addition to the GV | United States company list this week was Servotronics, Inc.

Westell Technologies’ Annual Meeting of Stockholders will take place on Tuesday with stated purposes that include:

To consider and act upon a proposal to amend the Company’s Amended and Restated Certificate of Incorporation (the “Charter”) to effect a reverse stock split of our Class A Common Stock and Class B Common Stock whereby, each outstanding one thousand (1,000) shares of the Company's Class A Common Stock and Class B Common Stock, respectively, would be combined into and become one (1) share of the Company's Class A Common Stock or Class B Common Stock, as applicable (the “Reverse Stock Split”).

To consider and vote upon a proposal to amend the Charter to effect, immediately after the Reverse Stock Split, a forward stock split of our Class A Common Stock and Class B Common Stock whereby, each one (1) share of the Company's Class A Common Stock and Class B Common Stock would divide into and become one thousand (1,000) shares of the Company's Class A Common Stock or Class B Common Stock, as applicable (the “Forward Stock Split,” and together with the Reverse Stock Split, the “Transaction”).

And —

Upon its effectiveness, the Transaction would result in (i) holdings prior to such split of fewer than one thousand (1,000) shares of Class A Common Stock or Class B Common Stock being converted into a fractional share, which will then be immediately cancelled and converted into a right to receive the cash consideration described in the attached proxy statement, and holdings greater than one thousand shares prior to such split will remain the same after the Transaction, and (ii) the Company having fewer than 300 stockholders of record of the Class A Common Stock, allowing the Company to deregister its Class A Common Stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and avoid the costs and time commitment associated with being a public reporting company.

Should Westell Technologies proceed with the “Transaction” (and barring any modification of terms), holders on record of fractional shares will receive $1.48 in cash in lieu of shares — as noted on July 13.

II. COMMUNITY INSIGHTS

Courtesy of Grahamian Value reader Daniel Toloko [linkedin | twitter]:

For peers searching for deep value opportunities beyond the United States (and/or, exceptional thought leaders) —

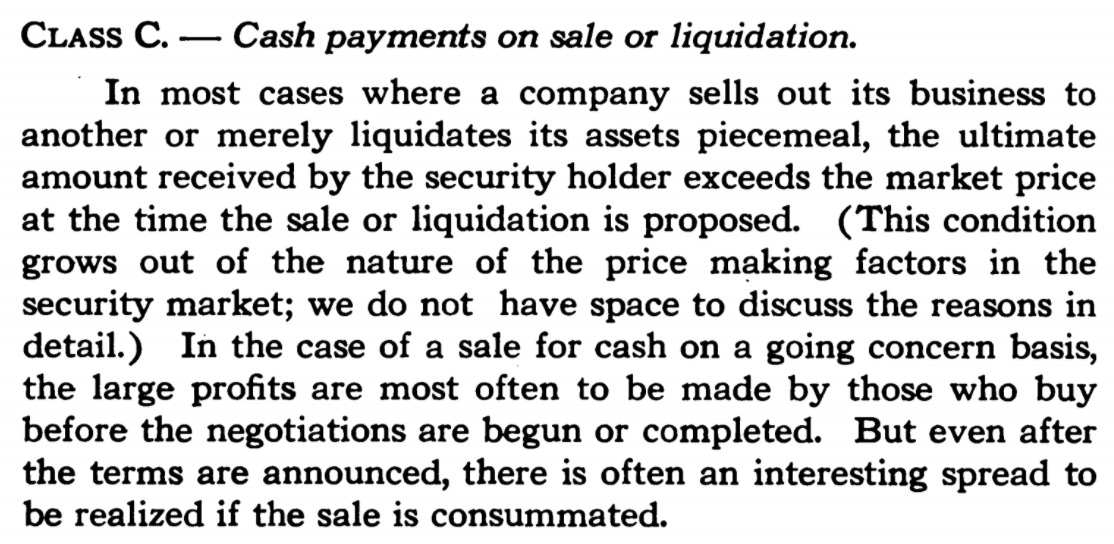

Benjamin Graham, “Special Situations” — The Analysts Journal, Fourth Quarter, 1946, Vol. 2, No. 4 (Fourth Quarter, 1946), pp. 35Compliments of Grahamian Value reader Daniel Sims [linkedin | twitter]:

An interesting “Class C” special situation —

(Full Disclosure: the co-editors are personal shareholders in Dawson Geophysical Co., Westell Technologies, Inc., and Luby’s, Inc.)

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a labor of love centered around our desire to openly share data and perspectives that we find helpful in our pursuit of Benjamin Graham-inspired investment ideas.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.